UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| þ Filed by the Registrant | ¨ Filed by a Party other than the Registrant |

| Check the appropriate box: | ||

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

REGIONS FINANCIAL CORPORATION

(Name of Registrant as Specified In Itsin its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| Payment of Filing Fee (Check the appropriate box): | ||

| þ | No fee required. | |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

(1)Title of each class of securities to which transaction applies: |

(2)Aggregate number of securities to which transaction applies: |

(3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4)Proposed maximum aggregate value of transaction: |

(5)Total fee paid: | ||

| ¨ |

| Fee paid previously with preliminary |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) Amount Previously Paid:

(1)Amount Previously Paid: | ||

(2)Form, Schedule or Registration Statement No.: | ||

(3)Filing Party: | ||

(4)Date Filed: |

REGIONS FINANCIAL CORPORATION

PROXY STATEMENT AND NOTICE OF 2016 ANNUAL MEETING OF STOCKHOLDERS |

REGIONS FINANCIAL CORPORATION

1900 Fifth Avenue North

Birmingham, Alabama 35203

Dear Fellow Stockholders:

To our Stockholders:

YouOn behalf of your Board of Directors, we are cordially invitedpleased to invite you to attend the annual meeting2016 Annual Meeting of the stockholdersStockholders of Regions Financial Corporation, to be held at 9:00 A.M., local time, on May 16, 2013, atApril 21, 2016, in the Upper Lobby Auditorium of Regions Bank, 1901 Sixth Avenue North, Birmingham, Alabama 35203.

Whether or not you are able to attend the meeting in person, we invite you to read this year’s proxy statement, which highlights key activities and accomplishments of 2015 and presents the matters for which we are seeking your vote at the 2016 meeting. Late last year, we held an Investor Day conference in New York where we reviewed our strategy to strengthen financial performance and build sustainable franchise value. Our business model is based on a solid foundation, which focuses on the strength of our team, our markets, our culture and our ability to execute. Additionally, we have identified steps Regions will take over the next three years to grow and diversify revenue, manage expenses and effectively deploy capital. As part of that effort, we have developed detailed plans to restructure our expense base to operate more efficiently while continuing to invest in revenue-producing businesses. We believe that these actions will accelerate our performance and drive growth and improved profitability in a challenging economy.

Overall, our 2015 performance reflected continued momentum in an environment that has presented some challenges for our industry. And while we entered 2016 with a rigorous focus on expense controls and improving operating efficiency, we also continue to focus on the fundamentals of our business, which — at its core — includes understanding and meeting our customers’ needs.

Throughout 2015, we continued our use of Regions360SM — our go-to-market strategy that allows us to effectively deliver Regions’ value proposition to customers. Regions360 begins with obtaining a fully detailed understanding of our customers’ financial needs. We connect their needs with the best products and services across all of our businesses to help customers achieve their financial goals. The end result is stronger customer relationships, a sustainable business, and communities that thrive. In addition, we also made investments in technology and other innovations during 2015 that are intended to enhance the level of service for our customers and drive revenue.

A letter from our Lead Independent Director follows this letter, as well as the formal notice of the annual meeting follows onsetting forth the next page.business that is expected to come before the meeting. Our materials also include our proxy statement and form of proxy. If you have elected to receive your proxy statement by mail, then accompanying the proxy statement isit will be accompanied by our Annual Report on Form 10-K for the year ended December 31, 2012.2015, and the Chairman’s Letter. If you have elected to receive your proxy statement electronically, then our Annual Report on Form 10-K for the year ended December 31, 2012 is availableyou will be able to access all of these documents on the internet with the proxy statement.Internet.

We are continuing to use the Securities and Exchange Commission rule that allows us to furnish our proxy materials to stockholders over the internet. This means most of our stockholders will receive only a notice containing instructions on how to access the proxy materials over the internet and vote online. We believe this offers a convenient way for stockholders to review the materials and also substantially reduces our printing and mailing expenses. If you receive this notice but would still like to receive paper copies of the proxy materials, please follow the instructions on the notice or on the website referred to on the notice. We ask you to consider signing up to receive these materials electronically in the future by following the instructions after you vote your shares over the internet. By delivering proxy materials electronically to our stockholders, we reduce the costs of printing and mailing our proxy materials. To enroll for electronic delivery, please visithttp://enroll.icsdelivery.com/rf.

We hope you will plan to attend the stockholders’ meeting. Your vote is important, and in order that we may be assured of a quorum, we urge you to vote as soon as possible, even if you plan to attend the meeting. The notice and the proxy statement contain instructions on how you can vote your shares over the internet,Internet, by mobile device, by telephone or by mail if you have received a printed copy of the materials and proxy card.

If your shares are held for you by your broker, it is important that you instruct your broker on how you want to vote. Under New York Stock Exchange rules, your broker will not be able to use its discretion to vote your shares for the election of Directors or matters related to executive compensation or the stockholder proposal.compensation. Please instruct your broker on how you want to vote by following the instructions on the form sent by your broker.

ThankOn behalf of the Board of Directors and the over 23,000 associates of Regions, I want to thank you for your continued interestinvestment in and support of Regions Financial Corporation.

Sincerely,March 8, 2016

| Sincerely,

O. B. Grayson Hall, Jr. Chairman, President and Chief Executive Officer |

REGIONS FINANCIAL CORPORATION

1900 Fifth Avenue North

Birmingham, Alabama 35203

Dear Fellow Stockholders:

As the Lead Independent Director of your Board of Directors, I am honored to have the opportunity to write to you, our stockholders, as part of this year’s proxy statement. The proxy statement affords us the opportunity to reach out to all of Regions’ stockholders to review, among many other things, where the Company has been and where we are going.

Over the past few years, we have enhanced our proxy statement to make it clearer, simpler, and more straightforward with a focus on what matters most to stockholders. This includes providing a better understanding of Regions’ strategy, corporate governance, and executive compensation. We hope the following pages will help you better understand the Company and how our governance and compensation practices are linked to performance and accountability in a manner that drives long-term stockholder value. As overseers of the Company, it is the Board’s responsibility to remain highly engaged in the Company’s strategic approach to creating stockholder value, and therefore, we must ensure that communication with our stockholders is a dialogue rather than a monologue. We appreciate your feedback and look forward to meaningful engagement on issues that are important to all of us.

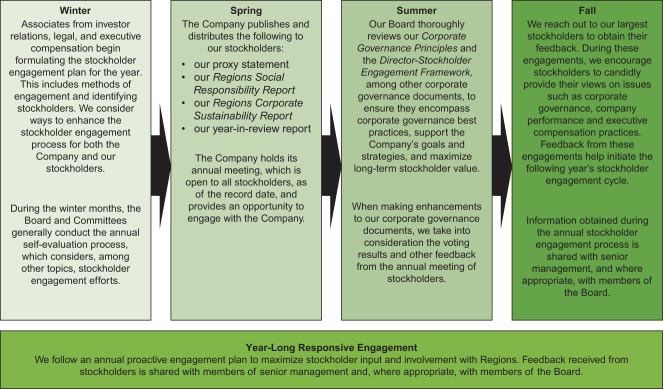

In 2015, Regions enhanced its stockholder outreach program. As part of this effort, during the summer of 2015, your Directors formalized a Director-Stockholder Engagement Framework to better define the roles of management and the Board, as well as stockholders, when engaging with one another. This Framework is designed to guide us all through the engagement process to ensure it is successful and beneficial for everyone involved.

Throughout the year, the Company conducted governance reviews and proactively reached out to stockholders on an individual basis to solicit their feedback on topics of importance to them. To reach a broad audience, Regions also hosted its 2015 Investor Day conference in New York, which was simultaneously webcast. This event was well-attended by investors and analysts and gave us the opportunity to set forth our long-term strategy, which involves, among other things, three areas of focus: (1) grow and diversify revenue, (2) practice disciplined expense management, and (3) effectively deploy capital. The Board remains very focused on the Company’s strategic initiatives to strengthen financial performance, which in turn, will foster long-term sustainable growth for our stockholders.

Let me also extend my heartfelt thanks to George W. Bryan who will not be standing for re-election this year as he reached our mandatory retirement age. He currently chairs the Risk Committee and has also served as a member of both the Audit Committee and the Compensation Committee. Throughout his tenure, he has shared his valuable time and insight, which proved crucial to the growth of Regions during a period of significant change in the financial services industry.

On behalf of the Board, I would like to express our sincere appreciation for the trust you have placed in us, and we look forward to serving you throughout the upcoming year.

March 8, 2016

| Sincerely,

Charles D. McCrary Lead Independent Director |

| TABLE OF CONTENTS |

| TABLE OF CONTENTS |

REGIONS FINANCIAL CORPORATION

1900 Fifth Avenue North

Birmingham, Alabama 35203

NOTICE OF 2016 ANNUAL MEETING OF STOCKHOLDERS

To be held May 16, 2013Thursday, April 21, 2016

TO THE STOCKHOLDERS OF REGIONS FINANCIAL CORPORATION:

The 2016 Annual Meeting of Stockholders of Regions Financial Corporation (“Regions”), a Delaware corporation, will hold its annual meeting of stockholders at the be held:

Date:Thursday, April 21, 2016

Time:9:00 A.M., local time

Place:Upper Lobby Auditorium of Regions Bank, 1901 Sixth Avenue North, Birmingham, Alabama 35203 at 9:00 A.M., local time, on May 16, 2013, to consider and vote upon

Record Date:February 22, 2016

The annual meeting is being held for the following matters:purposes:

| 1. | Election to our Board of Directors of the |

| 2. |

| 3. |

We also will act on any other business that may properly come before the meeting, although we have not received notice of any other matters that may be properly presented.

The Regions Board of Directors has fixed the close of business on March 18, 2013,February 22, 2016, as the record date for the annual meeting. This means that only Regions common stockholders of record at such timedate are entitled to notice of, and to vote at, the annual meeting or any adjournment or postponement of the annual meeting. A complete list of Regions stockholders of record entitled to vote at the annual meeting will be made available for inspection by any Regions stockholder for ten10 days prior to the annual meeting at the principal executive offices of Regions and at the time and place of the annual meeting.

The annual meeting will begin promptly at 9:00 A.M., local time, and check-in will begin at 8:00 A.M., local time. Please allow ample time for the check-in process.

To be admitted to our annual meeting, you must present proof of your stock ownership as of the record date and a valid, government-issued photo identification. See page 18 for further details regarding proof of stock ownership.Your vote is important. Whether or not you plan to attend the annual meeting, pleaseyou are encouraged to submit your proxy with voting instructions. To vote your shares, please follow the instructions in the Notice of Internet Availability of Proxy Materials or the proxy card you received in the mail. If you vote by telephone or via the Internet, you need not return a proxy card. You may revoke your proxy at any time before the vote overis taken by notifying the internet, by phoneCorporate Secretary of Regions in writing or by mail ifvalidly submitting another proxy by telephone, Internet or mail. If you received a printed proxy card or voter instruction form.This will not preventare present at the meeting, you from votingmay vote your shares in person, but itwhich will helpsupersede your proxy. If you hold shares through a broker or other custodian, check the voting instructions provided to secure a quorum and avoid added solicitation costs.you by that broker or custodian.

| March 8, 2016 |

| |||||||

By Order of the Board of Directors | ||||||||

| ||||||||

| Fournier J. Gale, III | ||||||||

REGIONS FINANCIAL CORPORATION

1900 Fifth Avenue North

Birmingham, Alabama 35203

March 8, 2016

FOR 2013 ANNUAL MEETING OF STOCKHOLDERS

The Board of Directors (the “Board”) of Regions Financial Corporation (“Regions”, “Company”, “we”, “us”, or “our”) is furnishing you with this proxy statement to solicit proxies on its stockholders in connection with the 2013 annual meeting of stockholdersbehalf to be voted at the 2016 Annual Meeting of Stockholders of Regions. The 2016 Annual Meeting will be held on Thursday, May 16, 2013 at 9:00 A.M., local time, atin the Upper Lobby Auditorium of Regions Bank, 1901 Sixth Avenue North, Birmingham, Alabama 35203 andon Thursday, April 21, 2016, at 9:00 A.M., local time. The proxies also may be voted at any adjournmentadjournments or postponement thereof. In this proxy statement, we refer to the Board of Directors as the “Board” and to Regions Financial Corporation as “we”, “us”, “Regions” or the “Company”. The matters to be considered and acted upon are (1) election of 14 nominees as Directors of Regions; (2) nonbinding stockholder approval of executive compensation; (3) approvalpostponements of the Regions Financial Corporation Executive Incentive Plan; (4) ratificationannual meeting.

The mailing address of our principal executive offices is 1900 Fifth Avenue North, Birmingham, Alabama 35203. We are first furnishing the selection of Ernst & Young LLP as Regions’ independent registered public accounting firm for the year 2013; (5) consideration of a stockholder proposal, which the Board opposes, regarding posting a report, updated semi-annually, of political contributions;proxy materials to stockholders on March 8, 2016.

All properly executed written proxies and (6) such other business as mayall properly come before the meeting or any adjournment or postponement of the meeting.

Your proxy is solicited on behalf of the Board. You may revoke your proxy at any time before it is voted at the annual meeting. You may submit your proxy by votingcompleted proxies submitted by telephone or on the internet by following the instructions provided. If you received a paper proxy card or voting instruction form, you may also vote by signing, dating, and returning the proxy card or voting instruction form in the envelope provided. All properly submitted proxiesInternet that are delivered pursuant to this solicitation will be voted at the meeting and2016 Annual Meeting of Stockholders in accordance with instructions, if any.the directions given in the proxy, unless the proxy is revoked prior to completion of voting at the meeting.

Only owners of record of shares of Regions common stock as of the close of business on February 22, 2016, the record date, are entitled to notice of, and to vote at, the meeting or at any adjournments or postponements of the meeting. Each owner of record on the record date is entitled to one vote for each share of common stock held. On February 22, 2016, there were 1,277,092,719 shares of common stock issued and outstanding.

As permitted by rules adopted byWe are continuing to use the Securities and Exchange Commission (“SEC”), Regions has electedrule that allows us to providefurnish our proxy materials to stockholders withover the Internet. This means most of our stockholders will receive only a notice containing instructions on how to access to ourthe proxy materials over the internet rather than providing them inInternet and vote online. This offers a convenient way for stockholders to review the materials while substantially reducing our printing and mailing expenses. If you receive the notice but would still like to receive paper form. Accordingly, beginning on or about March 29, 2013, Regions will send a Notice of Internet Availability of Proxy Materials with instructions for accessing the proxy materials via the internet, rather than a printed copycopies of the proxy materials, please follow the instructions on the notice or on the website referred to most stockholders. Stockholders may also obtain a copy ofon the notice.

We ask you to consider signing up to receive these materials electronically in printed formthe future by following the procedures set forth ininstructions after you vote your shares over the NoticeInternet. By delivering proxy materials electronically to our stockholders, we reduce the environmental impact of Internet Availability of Proxy Materials.our meeting. To enroll for electronic delivery, visithttp://enroll.icsdelivery.com/rf.

The date on which this proxy statement and form of proxy are first provided to security holders is March 26, 2013. The date of this proxy statement is March 26, 2013.IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

Important Notice Regarding Availability of Proxy Materials for the

Stockholder Meeting to be Held on May 16, 2013:FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON APRIL 21, 2016:

The Notice of Annual Meeting and Proxy Statement, and

Annual Report on Form 10-K for the year ended December 31, 2015

and Chairman’s Letter

are available atwww.regions.com orwww.proxyvote.com

2 ï 2016 Proxy Statement

ï 2016 Proxy Statement

ADMISSION TO THE ANNUAL MEETING

Admission to our 2016 Annual Meeting is limited to our registered and beneficial stockholders as of the record date and persons holding valid proxies from stockholders of record. To be admitted to our annual meeting, you must bring a valid, government-issued photo identification and proof of your stock ownership as of the record date, such as:

| • | If you are a stockholder of record, bring the Admission Ticket appearing on the top of your proxy card or bring the Notice of Internet Availability of Proxy Materials you received in the mail. |

| • | If your shares are held at a bank or broker, bring the Notice of Internet Availability of Proxy Materials you received in the mail or a brokerage statement evidencing ownership of Regions common stock as of the record date. |

| • | If you received our meeting materials electronically, bring a copy of the email notification. |

Stockholders who do not present the Admission Ticket or other proof of stock ownership will be admitted only upon verification of ownership at the registration desk.

For security reasons, no large bags, backpacks, briefcases or packages will be permitted in the annual meeting, and security measures will be in effect to provide for the safety of attendees. The use of any electronic devices such as cameras (including mobile phones with photographic capabilities), recording devices, smartphones, tablets, laptops and other similar devices is strictly prohibited.

Individuals with a disability requesting assistance please contact Regions’ Americans with Disabilities Act Manager Kathy Lovell by email at kathy.lovell@regions.com, by phone at 205-264-7495 or toll-free 1-800-734-4667, or using Regions’ Telecommunication Device for the Deaf (TTY/TDD) toll free at 1-800-374-5791.

ï 2016 Proxy Statement3

ï 2016 Proxy Statement3

| PROXY SUMMARY |

INFORMATION ABOUT REGIONSPROXY SUMMARY

This summary highlights certain information about Regions. This summary does not contain all of the information provided elsewhere in the proxy statement; therefore, you should read the entire proxy statement carefully before voting. For more

complete information regarding the Company’s 2015 performance, review the Company’s Annual Report on Form 10-K for the year ended December 31, 2015.

2016 Annual Meeting of Stockholders

• Date: | Thursday, April 21, 2016 | |

• Time: | 9:00 A.M., local time | |

• Place: | Regions Bank, Upper Lobby Auditorium 1901 Sixth Avenue North Birmingham, Alabama 35203 | |

• Record Date: | February 22, 2016 | |

• Voting: | Common stockholders as of the record date are entitled to vote. Stockholders of record can vote by proxy several ways: | |

| To vote with your mobile device (tablet or smartphone), scan theQuick Response Code that appears on your proxy card or Notice of Internet Availability of Proxy Materials (may require free software). | |

| To vote over the Internet, visitwww.proxyvote.com and enter your 16 digit control number that appears on your proxy card, email notification or Notice of Internet Availability of Proxy Materials. | |

| To vote by telephone, call1-800-690-6903 and follow the recorded instructions. If you vote by telephone, you also will need your 16 digit control number that appears on your proxy card. | |

| If you request printed copies of the proxy materials be sent to you by mail, vote by filling out the proxy card and send it back in the envelope provided to:Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, New York 11717. | |

| Additionally, you may votein personat the annual meeting. We will collect the proxy cards prior to the vote being finalized. | |

| If you hold your stock in street name or through the Regions Financial Corporation 401(k) Plan, seeQuestions and Answers about the Annual Meeting and Voting beginning on page 17 for more information about how to vote your shares. | ||

Admission to our annual meeting is limited to our registered and beneficial stockholders as of the record date and persons holding valid proxies from stockholders of record. To be admitted to our annual meeting, you must bring proof of your stock ownership as of the record date or a valid proxy and a valid, government-issued photo identification. See page 18 for further details.

Admission to our annual meeting is limited to our registered and beneficial stockholders as of the record date and persons holding valid proxies from stockholders of record. To be admitted to our annual meeting, you must bring proof of your stock ownership as of the record date or a valid proxy and a valid, government-issued photo identification. See page 18 for further details.

4  ï 2016 Proxy Statement

ï 2016 Proxy Statement

| PROXY SUMMARY |

Proposals That Require Your Vote

| �� | Board Recommendation | More Information | Votes Required for Approval | |||||

| PROPOSAL 1 | Election of Directors | FOR each Nominee | Page 26 | Affirmative “FOR” vote of a majority of the votes cast for or against each of these proposals. Abstentions and broker non-votes have no effect on the vote results for these proposals. | ||||

| PROPOSAL 2 | Ratification of Appointment of Independent Registered Public Accounting Firm | FOR | Page 57 | |||||

| PROPOSAL 3 | Nonbinding Stockholder Approval of Executive Compensation | FOR | Page 60 |

Information about Regions

Regions (NYSE:RF) is a financial holding company headquartered in Birmingham, Alabama, whichthat operates in the South, Midwest and Texas. Regions, through its subsidiaries, provides traditional commercial, retail and mortgage banking services, as well as other financial services in the fields of investment banking, asset management, trust, mutual funds,wealth management, securities brokerage, insurance, trust services, merger and acquisition advisory services and specialty financing.

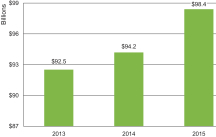

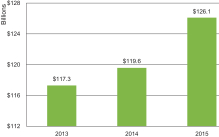

At December 31, 2012,2015, Regions had total consolidated assets of approximately $121.3$126.1 billion, total consolidated deposits of approximately $95.5$98.4 billion and total consolidated stockholders’ equity of approximately $15.5$16.8 billion.

Regions is a Delaware corporation. Regions’ principal executive offices are located at 1900 Fifth Avenue North, Birmingham, Alabama 35203. Regions is a member of the S&P 500 Index and is the 18th largest full-service bank holding company in the nation.

Regions conducts its banking operations through Regions Bank, an Alabama state-chartered commercial bank that is a member of the Federal Reserve System. At December 31, 2015, Regions Bank operated 1,962 ATMs and 1,627 banking offices in 16 states.

Our Strategy

Together, our values, mission and vision guide us in developing our business strategy. While our strategic priorities, appearing in the graphic to the right, guide our day-to-day operations, Regions developed a comprehensive three-year strategic plan in 2015 designed to further promote long-term stockholder value. As our 2016-2018 strategic financial plan was prepared and reviewed with our Board, our executive management team worked to ensure there was alignment of our corporate strategy with our Board-approved Risk Appetite Statement. The essence of our strategy demonstrates the strength of our culture, our markets, our team and our strong capital base, as well as our commitment to execute a plan that will deliver sustainable performance and stockholder returns over the next three years.

2016-2018 Strategic Initiatives

ï 2016 Proxy Statement5

ï 2016 Proxy Statement5

| PROXY SUMMARY |

The Foundation of our Growth

Throughout 2015, we continued using Regions360SM, our go-to-market strategy that allows us to effectively deliver our value proposition to customers. Regions360 begins with obtaining a detailed understanding of our customers’ financial needs. We connect their needs with the best products and services across all of our businesses to help customers achieve their financial goals. The end result is stronger customer relationships, a sustainable business and communities that thrive.

In 2015, we continued to make steady progress growing customer accounts, deposits, loans and Regions360 relationships. The growth was broad-based across our footprint and across the many products and services we offer our customers.

Strength of Culture

Our basic values, beliefs and mission reflect our culture.

Regions’ mission is to achieve superior economic value for our shareholders over time by making life better for our customers, our associates and our communities and creating shared value as we help them meet their financial goals and aspirations. |

|

Our Vision Statement

Regions aims to be the premier regional financial institution in America through being deeply embedded in its communities, operating as one team with the highest integrity, providing unique and extraordinary service to all of its customers and offering an unparalleled opportunity for professional growth for its associates.

Our vision statement is an aspiration, and it defines our future. It is meant to clarify what we do, where we do it and how we will execute. We aim to achieve our vision by providing expert financial advice, guidance and education to customers; by building well-developed business plans that we execute with discipline; by building on a foundation of integrity and trust throughout our business; by delivering excellent customer service and convenience; and by offering our associates the opportunity to grow professionally and work on an outstanding team.

We believe how we reach our potential is just as important as what we achieve. While a company can claim corporate ideals or adopt a tremendous vision statement, ultimately it is a company’s associates who embody those ideals.

Our Corporate Values

In Regions’ case, our corporate values are not simply the values of a legal entity; they are values that encompass the ethics and commitment of over 23,000 associates. Our values are the statement of how we will do business; they are a promise and a measuring stick against which to judge our behavior and results:

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING6  ï 2016 Proxy Statement

ï 2016 Proxy Statement

| PROXY SUMMARY |

$81.2B $98.4B $126.1B * See reconciliation in Regions’ Annual Report on Form 10-K for the year ended December 31, 2015 on page 46.What isReach Higher:Grow. Our company must grow, and we must grow prudently. Raise the purpose ofbar. Be energetic. Be innovative. Achieve excellence. Improve continuously. Inspire and enable others. Succeed the meeting?right way. Improve efficiency and effectiveness.At our annual meeting, stockholders will act upon the matters outlinedEnjoy Life:Have fun. We are in the Noticebusiness of Annual Meeting of Stockholders and described in this proxy statement.A proxy statement is a document thatbanking. But more importantly, we are required to give you, or provide you access to, when we are soliciting your vote in accordance with regulationsthe business of the SEC.What is a proxy?2015 Year-End Business HighlightsA proxy is your designation of another person to vote stock that you own. That other person is called a proxy. If you designate someone as your proxy in a written document, that document also is called a proxy or a proxy card. When you designate a proxy, you may also direct the proxy how to vote your shares. We refer to this as your “proxy vote”. Fournier J. Gale, III, our Corporate Secretary, and Carl L. Gorday, an Assistant Corporate Secretary, have been designated as the proxies to cast the votes of our stockholders at our 2013 annual meeting of stockholders.What is the difference between being a stockholder of record and a “street name” holder or “beneficial owner”?If your shares are registered directly in your name with our transfer agent, Computershare Investor Services, you are considered the stockholder of record with respect to those shares. If your shares are held in a brokerage account or by another nominee, you are considered the “beneficial owner” of shares held in “street name”.Who is entitled to vote at the meeting?The Board has set March 18, 2013, as the record date for the annual meeting. If you were a stockholder of record at the close of business on March 18, 2013, you are entitled to vote at the meeting. As of the record date, 1,413,429,806 shares of our common stock were issued and outstanding and, therefore, eligible to vote at the meeting.Holders of our common stock are entitled to one vote per share. Therefore, a total of 1,413,429,806 votes are entitled to be cast at the meeting. There is no cumulative voting.The Board is soliciting proxies so that you can vote before the annual meeting. Even if you currently plan to attend the meeting, we recommend that you vote by proxy before the meeting to ensure that your vote will be counted.If you are the record holder of your shares, there are three ways you can vote by proxy:By InternetLoans 5% v. 2014

5% v. 2014 You may vote over the internet by going towww.proxyvote.com and entering your 12 digit control number that appears on your proxy card, e-mail notification or notice of internet availability of proxy materials.

By TelephoneDeposits 4% v. 2014

4% v. 2014 You may vote by telephone by calling 1-800-690-6903 and following the recorded instructions. If you vote by telephone, you will also need your control number referred to above.

By MailAssets 5% v. 2014

5% v. 2014 If you request printed copies of the proxy materials be sent to you by mail, you may vote by proxy by filling out the proxy card and sending it back in the envelope provided.If your shares are held in nominee or “street name”, you may vote your shares before the meeting by phone or over the internet by following the instructions on the notice of internet availability of proxy materials you received or, if you received a voting instruction form from your brokerage firm, by mail by completing, signing and returning the form you received. You should check your voting instruction form to see if internet or telephone voting is available to you. Although most brokers and nominees offer telephone and internet voting, availability and specific processes will depend on their voting arrangements.If you have internet access, we encourage you to record your vote through the internet to reduce corporate expense. The deadline for voting by telephone or through the internet is 11:59 P.M., Eastern Time on May 15, 2013.Can I change my vote after submitting my proxy?If you voted over the internet or by telephone, you can change your vote by voting again over the internet or by telephone before 11:59 P.M., Eastern Time on May 15, 2013.You can revoke your proxy at any time before the vote is taken at the annual meeting by submitting to our Corporate Secretary written notice of revocation or a properly executed proxy of a later date, or by attending the annual meeting and voting in person. Written notices of revocation and other communications about revoking Regions proxies should be addressed to:Regions Financial Corporation1900 Fifth Avenue NorthBirmingham, Alabama 35203Attention: Fournier J. Gale, III, Corporate SecretaryIf your shares are held in street name, you should follow the instructions of your broker regarding the revocation of proxies.How does the Board recommend that I vote?For the reasons set forth in more detail later in this proxy statement, the Board recommends you vote:FOR all the director nominees named in this proxy statement (Proposal 1);FORthe nonbinding stockholder approval of executive compensation (Proposal 2);FOR the approval of the Regions Financial Corporation Executive Incentive Plan (Proposal 3);FOR the ratification of Ernst & Young LLP as Regions’ independent registered public accounting firm for the year 2013 (Proposal 4); andAGAINSTthe stockholder proposal regarding posting a report, updated semi-annually, of political contributions (Proposal 5).All shares represented by valid proxies that we receive through this solicitation, and that are not revoked, will be voted in accordance with the instructions received.We are not aware of any other matters that will be voted on at the annual meeting. However, if other matters properly come before the annual meeting, or at any adjournment or postponement thereof, the persons named as proxies for shareholders will vote on those matters in a manner they consider appropriate.What if I do not specify how I want my shares voted?If you requested printed copies of the proxy materials and sign and return your proxy card without giving specific voting instructions, your proxy will be voted following the Board’s recommendations above.Our telephone and internet voting procedures do not permit you to submit your proxy vote by telephone or internet without specifying how you want your shares voted.What does it mean if I receive more than one notice or more than one set of paper proxy materials?If you own shares of common stock in more than one account—for example, in a joint account with your spouse and in your individual brokerage account—you may have received more than one notice or more than one set of paper proxy materials. To vote all of your shares by proxy, please follow each of the separate proxy voting instructions that you received for your shares of common stock held in each of your different accounts.What if I hold my shares in street name and do not provide voting instructions?If your shares are held in a brokerage account or by another nominee, you are considered the “beneficial owner” of shares held in “street name” and you received either a paper copy of these proxy materials along with a voting instruction form or a notice of internet availability of these proxy materials from your broker or nominee (the “record holder”). As the beneficial owner, you have the right to direct your record holder how to vote your shares, and the record holder is required to vote your shares in accordance with your instructions.The New York Stock Exchange (“NYSE”) has changed its rules to eliminate the ability of brokers that are NYSE member firms to vote on the election of directors, on matters related to executive compensation or on certain other matters without instruction from their clients. Prior to these changes, such brokers had discretionary authority to cast votes regarding these matters. Therefore, it is important for stockholders who hold their shares with brokers to instruct their broker on how to vote their shares, and we urge all stockholders to do so.A broker non-vote occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee has not received voting instructions from the beneficial owner and does not have discretionary voting power with respect to that item. As noted above, under NYSE rules, brokers or other nominees may not exercise discretionary voting power on certain matters. Brokers and other nominees who are NYSE members are expected to have discretionary voting power only for Proposal 4 (ratification of the selection of Ernst & Young LLP as independent registered public accounting firm). Brokers and other nominees will not be able to vote your shares regarding Proposal 1 (election of Directors), Proposal 2 (nonbinding stockholder approval of executive compensation), Proposal 3 (approval of the executive incentive plan), andProposal 5 (stockholder proposal regarding posting a report, updated semi-annually, of political contributions), unless you return your voting instruction form or submit your voting instructions by telephone or over the internet.Who pays for the cost of proxy preparation and solicitation?We will bear the entire cost of soliciting your proxy, including the cost of preparing, assembling, printing, mailing or otherwise distributing the notice and these proxy materials, as well as soliciting your vote. In addition to solicitation of proxies by mail, we will request that banks, brokers and other record holders send proxies and proxy materials or notice of internet availability of proxy materials to the beneficial owners of Regions common stock and secure their voting instructions. We will reimburse the record holders for their reasonable expenses in taking those actions. We have also made arrangements with Innisfree M&A Incorporated to assist us in soliciting proxies and have agreed to pay that company $15,000 plus reasonable and customary expenses for these services. If necessary, we may also use several of our regular employees, without additional compensation, to solicit proxies from Regions stockholders, either personally or by telephone, facsimile, e-mail or letter on Regions’ behalf.This is the first distribution of proxy solicitation materials to stockholders.If you have any questions or need assistance voting your shares, please contact our proxy solicitor:Innisfree M&A Incorporated501 Madison Avenue, 20thFloorNew York, NY 10022Stockholders May Call Toll-Free: 1-888-750-5834Banks and Brokers May Call Collect: 1-212-750-5833How many shares must be present to hold the meeting?The presence, in person or by properly executed or otherwise documented proxy, of the holders of a majority of the outstanding shares of Regions common stock is necessary to constitute a quorum at the annual meeting. Abstentions and broker non-votes will be counted solely for the purpose of determining whether a quorum is present. We urge you to vote promptly by proxy even if you plan to attend the annual meeting so that we will know as soon as possible that enough shares will be present for us to hold the meeting. Holders of our Depositary Shares, each representing 1/40th interest in a share of our Non-Cumulative Perpetual Preferred Stock, Series A (the “Depositary Shares”), are not entitled to vote at the annual meeting.Representatives of Broadridge Financial Solutions, Inc., our tabulation agent, will tabulate the votes and act as independent inspectors of election.What vote is required and what is the effect of abstentions?You may vote “FOR”, “AGAINST” or “ABSTAIN” for each nominee for the Board of Directors and on the other proposals. Abstentions and broker non-votes will have no effect on the election of Directors or on the remaining matters to be considered at the meeting.Election of Directors (Proposal 1). Under Regions By-laws, each of the 14 nominees for Director will be elected if a majority of the votes cast at the annual meeting at which a quorum is present are voted in favor of the Director. This means that the number of shares voted “for” a nominee must exceed the number of shares voted “against” the nominee. Regions’ Certificate of Incorporation does not authorize cumulative voting in the election of Directors. Under the Regions Corporate Governance Principles, an incumbent Director nominee who fails to receive a majority of the votes cast with respect to the election of the incumbent Director nominee must submit his or her resignation. The Nominating andCorporate Governance Committee will consider the resignation and any factors they deem relevant in deciding whether to accept the resignation and recommend to the Board the action to be taken. The Director whose resignation is under consideration will abstain from participating in any decision regarding his or her resignation. The Board will take action within 90 days following certification of the stockholder vote unless such action would cause Regions to fail to comply with requirements of the NYSE or of the securities laws in which event Regions will take action as promptly as practicable while continuing to meet such requirements. The Board will promptly disclose its decision and the reasons therefore in a Form 8-K filed with the SEC. If the resignation is not accepted, the Director will continue to serve until the next annual meeting and until the Director’s successor is duly elected and qualified. We reported net income from continuing operations available to common stockholders totaling $1 billion and diluted earnings per common share of $0.76.

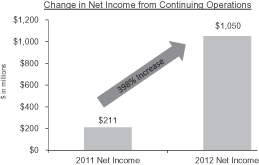

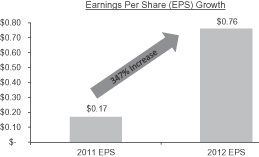

We reported net income from continuing operations available to common stockholders totaling $1 billion and diluted earnings per common share of $0.76.NonbindingWe returned $927 million to our owners in the form of quarterly dividends and common share repurchases or 93 percent of net income available to common stockholders.We realized a healthy 4 percent growth in adjusted non-interest income.*We maintained a strong capital level with year-end Basel III Tier 1 Capital and Total capital ratios of 11.65 percent and 13.88 percent, respectively. ï 2016 Proxy Statement7

ï 2016 Proxy Statement7 PROXY SUMMARY

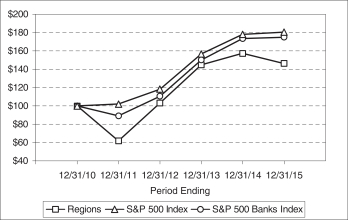

Stock Performance Graph

This graph shows the cumulative total stockholder approval of executive compensation (Proposal 2). Under our By-Laws, the nonbinding stockholder approval of executive compensation will be approved if the affirmative vote of a majorityreturn for Regions common stock in each of the votes cast are voted “FOR” this proposal.five years from December 31, 2010, to December 31, 2015. The graph also compares the cumulative total returns for the same five-year period with the S&P 500 Index and the S&P 500 Banks Index.

The comparison assumes $100 was invested on December 31, 2010, in Regions common stock, the S&P 500 Index, and the S&P 500 Banks Index and that all dividends were reinvested.

| Cumulative Total Return | ||||||||||||||||||||||||

| 12/31/10 | 12/31/11 | 12/31/12 | 12/31/13 | 12/31/14 | 12/31/15 | |||||||||||||||||||

Regions | $ | 100.00 | $ | 61.93 | $ | 103.31 | $ | 144.87 | $ | 157.37 | $ | 146.48 | ||||||||||||

S&P 500 Index | $ | 100.00 | $ | 102.11 | $ | 118.43 | $ | 156.77 | $ | 178.22 | $ | 180.67 | ||||||||||||

S&P 500 Banks Index | $ | 100.00 | $ | 89.28 | $ | 110.76 | $ | 150.33 | $ | 173.64 | $ | 175.12 | ||||||||||||

Economic Development and Community Outreach

We participated in several economic development initiatives during 2015. In August, Regions served as lead sponsor to an Inner City Capital Connections conference held in Birmingham, which serves to educate companies in or near city centers on how to access capital to expand their businesses.

In addition, our associates made a positive difference in the communities we served throughout 2015:

| • | Trained over 150 facilitators to incorporate financial education into classrooms and parent workshops, and the Regions at Work® team presented over 59,000 financial education seminars during the year throughout our footprint. |

Approval

Regions also makes an indirect economic impact by taking an active role in economic development throughout our footprint. In 2013, Regions established the Alabama Economic Development Loan Pool, and at that time, earmarked $1 billion to provide economic development capital and support job growth in Alabama. Since 2013, the loan pool amount has been increased to $1.5 billion.

Regions is one of the nation’s leading direct investors in Low Income Housing Tax Credit projects. In 2015, Regions Financial Corporation Executive Incentive Plan (Proposal 3)invested more than $231 million in such tax-credit partnerships, supporting 46 developments that provided 3,670 units of affordable housing for low- and moderate-income individuals and families, all within our footprint.

Corporate Social Responsibility

Corporate social responsibility at Regions encompasses coordinating, tracking and reporting our progress around diversity and inclusion; our corporate response when disasters strike; our environmental impact; and our economic development, sustainability and associate volunteer efforts. Key initiatives and activities include:

8  ï 2016 Proxy Statement

ï 2016 Proxy Statement

| PROXY SUMMARY |

At Regions, we recognize diversity and inclusion are essential to achieving and maintaining a thriving company, and our commitment is reinforced through our ongoing efforts to reflect, anticipate and adapt to the changing demographics of the communities where we live and work. Our public commitment to these efforts is supported by our Directors, executive management, and associates. Our strategic approach to diversity and inclusion — inside and outside of Regions — is not only good business, it is the right thing to do for our customers, communities, associates and stockholders. We have a cross-functional network of Regions associates who work together to advance the Company’s comprehensive diversity and inclusion strategy. Additionally, the Regions Diversity Advisory Council, composed of academic, community, and business leaders, offers an objective perspective on matters of diversity and inclusion in our workplace and marketplace.

Regions also supports the communities in which we operate by striving to minimize our environmental impact. This requires us to be mindful of every decision we make and to continually seek areas in which we can improve. For example, in 2015:

through Duke Energy’s GoGreen Indiana Initiative. The energy for this particular program is generated from regional wind sources. |

Policy on Political Contributions

Regions’ Policy on Political Contributions and Code of Business Conduct and Ethics both govern and promote the Treasury Regulations promulgatedhighest standards of behavior by our Company and our associates with regard to political activities. The policies also ensure compliance with all current applicable federal and state campaign finance laws. Like most public companies, Regions recognizes that decisions made by governmental agencies and lawmakers can have a significant impact on our operations, stockholders, customers and associates. Accordingly, we monitor and track issues that affect our business and express our views to lawmakers and regulators.

Regions may make corporate political contributions in states where permissible. These contributions may be directed to state party organizations and candidates for statewide offices, state legislatures and, in rare instances, local offices.

Also, where legally permitted, Regions may make independent expenditures or corporate contributions in connection with state and local ballot initiatives and referenda on important policy issues that are likely to impact our business and our stakeholders. Regions does not, however, make contributions to political entities organized under Section 162(m)527 of the Internal Revenue Code the executive incentive plan will be approved if the affirmative vote of a majorityor to special interest lobbying groups organized under Section 501(c)(4) of the votes cast are voted “FOR” this proposal.Internal Revenue Code to support political activities, even when legally permissible.

Ratification of the selection of Ernst & Young LLP as Regions’Regions discloses annually its independent registered public accounting firm for the year 2013 (Proposal 4). Under our By-Laws, the ratification of Ernst & Young LLP will be approved if the affirmative vote of a majority of the votes cast are voted “FOR” this proposal.

Stockholder proposal regarding posting a report, updated semi-annually, ofexpenditures and corporate political contributions (Proposal 5). Under our By-Laws, the stockholder proposal will be approved if the affirmative vote of a majority of the votes cast are voted “FOR” this proposal.

Can I vote my shares in person at the meeting?

We recommend that you submit your proxy as described above so that your vote will be counted if you later decide not to attend the meeting. You may vote in person at the annual meeting if you are a stockholder of record on the record date.

If your shares are held in street name, you will have to obtain a written proxy in your name from the broker, bank or other nominee who holds your shares and bring that written proxy with you to the meeting.

If you are a stockholder of record and plan to attend the meeting, please so indicate on your returned proxy card or electronic vote. Only record or beneficial owners of Regions common stock or their proxies may attend the annual meeting in person. Admission to the annual meeting will be on a first-come, first-served basis. When you arrive at the annual meeting, you may be requested to present photo identification, such as a driver license. Beneficial owners must also provide evidence of stock holdings, such as a recent brokerage account statement. Registration will begin one hour prior to the beginning of the meeting. The use of cell phones (including camera phones), pagers, computers, PDAs, cameras, video or recording equipment, or any other electronic device is not permitted in the Auditorium. Additional rules of conduct will be provided at the meeting. Failure to follow these rules can result in your removal from the meeting.

If you are not able to attend the meeting, you will still be able to access a replay of the management presentation given after the business items have been concluded. You can find instructions on how to access the replay of the presentation materialsgiving on the Investor Relations section of our website atwww.regions.com. www.regions.com.

Recognition

Thanks to our talented, dedicated team of associates, Regions received industry recognition in a number of categories throughout the year, including:

| • | Ranked Most Reputable Bank in the United States in the Reputation Institute/American Banker survey |

| • | Corporate Secretary’s Corporate Governance Awards: Finalist for Best Proxy Statement, Large Cap |

ï 2016 Proxy Statement9

ï 2016 Proxy Statement9

| PROXY SUMMARY |

How do I vote if my shares are held

Cybersecurity

If you

As a financial institution, we are a participant intrusted with sensitive information, which we are expected to protect. Regions considers the Regions 401(k) Plan,safekeeping of our customer, associate, and Company data to be of paramount importance. As such, our risk management program, which is overseen by the electronic voting instructions constitutes the voting instruction form and covers all shares you may vote under the plan. Under the termsRisk Committee of the plan, the trustee votes all shares held by the plan, but each participant may direct the trustee howBoard, includes a robust cybersecurity program. We employ a team of information security

specialists who are tasked with keeping data safe, and we have implemented multiple layers of defense to vote the shares of Regions common stock allocated to his or her plan account. If you own shares through the Regions 401(k) Plan and do not submit voting instructions, the plan trustee will vote the shares in favor of Proposals 1, 2, 3 and 4,protect against Proposal 5. The deadlineintrusions.

See page 49 for returning your 401(k) voting instructions is 11:59 P.M. Eastern Time on May 13, 2013.a more in-depth look at Regions’ cybersecurity risk management program.

Stockholder Engagement

If youRegions values the viewpoints of our stockholders, and we are a participant incommitted to providing our stockholders with the Computershare Investment Plan forability to express their opinions. Therefore, Regions Financial Corporation, the proxy card or electronic voting instructions covers all shares allocated to your account under that plan. If you do not return your proxy card, or vote by telephone orhas taken steps over the internet, your shares in that plan will not be voted. If you return your proxy card without indicating your voting instructions, the shares will be voted in favor of Proposals 1, 2, 3 and 4, against Proposal 5. past year to strengthen our stockholder engagement efforts.

The deadline for returning your voting instructions for that plan is 11:59 P.M. Eastern Time on May 15, 2013.following chart describes Regions’ annual stockholder engagement cycle:

Notice and Access is a SEC rule that allows us to furnish our proxy materials over the internet to our stockholders instead of mailing paper copies of those materials to each stockholder. As a result beginning on or about March 29, 2013, we will send to mostof engaging with our stockholders by mail or e-mail a notice containing instructions on how to access our proxy materials over the internet and vote online.past few years, we have taken the following actions:

Name and Address of Beneficial Owner BlackRock, Inc. (and subsidiaries) (1) 40 East 52nd Street New York, NY 10022 The Vanguard Group, Inc. (2) Vanguard Fiduciary Trust Company 100 Vanguard Blvd. Malvern, PA 19355 This notice is not a proxy cardMade publicly available Regions’ political spending and cannot be used to vote your shares. If you received a notice this year, you will not receive paper copies of the proxy materials unless you request the materials by following the instructions on the notice or on the website referred to on the notice.How can I receive my proxy materials electronically in the future?Stockholders can elect to view future Regions proxy statements and annual reports through the internet instead of receiving paper copies in the mail and thus can save Regions the cost of producing and mailing these documents. If you already have internet access, there will be no additional charge for you to have electronic access through the internet to our proxy materials and annual report.If you are a registered stockholder, you can choose to receive future annual reports and proxy statements electronically by following the prompt if you choose to vote through the internet. Stockholders who choose to view future proxy statements and annual reports through the internet will receive an e-mail with instructions containing the internet address of those materials, as well as voting instructions, approximately four weeks before future meetings.If you enroll to view our future annual reports and proxy statements electronically and vote your proxy through the internet, your enrollment will remain in effect for all future stockholder meetings unless you cancel it. To cancel, registered stockholders should accesshttp://enroll.icsdelivery.com/rf and follow the instructions to cancel your enrollment. If you hold your Regions stock in nominee name, check the information provided by your nominee for instructions on how to cancel your enrollment.If at any time you would like to receive a paper copy of the annual report or proxy statement, please write to Investor Relations, Regions Financial Corporation, 1900 Fifth Avenue North, Birmingham, Alabama 35203 or call us at 205-326-5807.IMPORTANT NOTICE REGARDING DELIVERY OF SECURITY HOLDER DOCUMENTSThe SEC has issued rules regarding the delivery of proxy statements and information statements to households. These rules spell out the conditions under which annual reports, information statements, proxy statements, prospectuses and other disclosure documents of a particular company that would otherwise be mailed in separate envelopes to more than one person at a shared address may be mailed as one copy in one envelope addressed to all holders at that address (i.e., “householding”). To conserve resources and reduce expenses, we consolidate materials under these rules when possible. Stockholders who participate in householding will receive separate proxy cards.Because we are using the SEC’s notice and access rule, we will not household our proxy materials or notices to stockholders of record sharing an address. This means that stockholders of record who share an address will each be mailed a separate notice of the proxy materials. However, certain brokerage firms, banks, or similar entities holding our common stock for their customers may household proxy materials or notices. Stockholders sharing an address whose shares of our common stock are held in street name should contact their broker if they now receive (1) multiple copies of our proxy materials or notices and wish to receive only one copy of these materials per household in the future, or (2) a single copy of our proxy materials or notice and wish to receive separate copies of these materials in the future. If at any time you would like to receive a paper copy of the annual report or proxy statement, please write to Investor Relations, Regions Financial Corporation, 1900 Fifth Avenue North, Birmingham, Alabama 35203 or call us at 205-326-5807.VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOFAs of March 18, 2013, Regions had issued 1,454,462,482 shares of common stock, of which 1,413,429,806 shares were outstanding and 41,032,676 shares were held as treasury stock. Treasury stock cannot be voted. Stockholders are entitled to one vote for each share on all matters to come before the meeting. Only common stockholders of record at the close of business on March 18, 2013 (the “Record Date”), will be entitled to vote at the meeting or any adjournment or postponement thereof. Holders of the Depositary Shares are not entitled to vote at the annual meeting. As of March 18, 2013, 2,000,000 Depositary Shares were issued and outstanding.Security Ownership of Certain Beneficial OwnersThe following table sets forth the beneficial ownership of our common stock by any stockholder known to us, based on public filings made with the SEC, to own 5% or more of the outstanding shares of our common stock. Amount and Nature of Beneficial

Ownership No. of

Common Shares % of Class 84,236,542 5.96 % 84,154,756 5.95 % (1)• This information was derived from the Schedule 13G filed on January 30, 2013 by BlackRock, Inc. and subsidiaries, which states that BlackRock has sole voting and dispositive power over 84,236,542 shares.Included a summary of our strategy in ourProxy Summary(2)• This information was derived fromAdded more detail to our overall company performance in the Schedule 13G filed February 11, 2013 by The Vanguard Group, Inc. and subsidiaries, which states that The Vanguard Group, Inc. has sole dispositive power over 81,842,789 shares.Proxy SummaryEnhanced proxy disclosures with respect to our independent auditorPublicly disclosed a summary of Directors and Managementthe Director-Stockholder Engagement Framework on our websiteEnhanced disclosures around executive compensation practicesThe following table presents information about beneficial ownership of Regions equity securitiesWe encourage all stockholders as of the Record Date byrecord date to attend this year’s annual meeting, as this provides you with an opportunity to engage in direct dialogue with the Directors and certain executive officers of Regions. Unless otherwise indicated, each person has sole voting and investment power over the indicated shares. A person is deemed to be a beneficial owner of any security of which that person has the right to acquire beneficial ownership within 60 days from the Record Date. The footnotes to the table indicate how many shares each person has the right to acquire within 60 days of the Record Date. The shares of Regions common stock whichCompany. Our stockholder engagements efforts are issuable to a person listed below upon exercise of the vested portion of the outstanding options are assumed to be outstanding for the purpose of determining the percentage of shares beneficially owned by that person.further detailed on pages 38-39.Most of the Directors of Regions have elected to defer receipt of some or all of the cash compensation they are due for services on the Board of Directors in the Directors’ Deferred Stock Investment Plan. Each Director’s deferred amounts are credited as notional shares of Regions common stock as of the time of deferral and will be settled in actual shares of common stock at the end of the deferral period. Therefore, the ultimate value of the amounts deferred will be tied to the performance of Regions stock. As of March 18, 2013, the Directors as a group were credited with 679,607 notional shares of common stock, which are not included in the table below. The footnotes to the table indicate how many shares are allocated to each Director in the Plan.

| Amount and Nature of Beneficial Ownership as of March 18, 2013 | ||||||||||

Name of Beneficial Owner | Class of Securities | No. of Shares | % of Class | |||||||

Current Directors including nominees for Director | ||||||||||

Samuel W. Bartholomew, Jr. | Common Stock | 95,447 | (1) | * | ||||||

George W. Bryan | Common Stock | 145,406 | (2) | * | ||||||

Carolyn H. Byrd | Common Stock | 30,760 | (3) | * | ||||||

David J. Cooper, Sr. | Common Stock | 151,881 | (4) | * | ||||||

Earnest W. Deavenport, Jr. | Common Stock | 153,833 | (5) | * | ||||||

Don DeFosset | Common Stock | 68,679 | (6) | * | ||||||

Eric C. Fast | Common Stock | 30,760 | (7) | * | ||||||

| Depositary Shares | 16,000 | * | ||||||||

O. B. Grayson Hall, Jr. | Common Stock | 1,664,335 | (8) | * | ||||||

John D. Johns | Common Stock | 24,249 | (9) | * | ||||||

Charles D. McCrary | Common Stock | 105,138 | (10) | * | ||||||

James R. Malone | Common Stock | 125,714 | (11) | * | ||||||

Ruth Ann Marshall | Common Stock | 25,718 | (12) | * | ||||||

Susan W. Matlock | Common Stock | 68,103 | (13) | * | ||||||

John E. Maupin, Jr. | Common Stock | 61,003 | (14) | * | ||||||

John R. Roberts | Common Stock | 86,118 | (15) | * | ||||||

Lee J. Styslinger III | Common Stock | 76,028 | (16) | * | ||||||

Other named executive officers (See Summary Compensation Table) | ||||||||||

David J. Turner, Jr. | Common Stock | 342,687 | (17) | * | ||||||

David B. Edmonds | Common Stock | 814,118 | (18) | * | ||||||

Fournier J. Gale, III | Common Stock | 134,319 | (19) | * | ||||||

| Depositary Shares | 8,000 | * | ||||||||

John B. Owen | Common Stock | 510,432 | (20) | * | ||||||

Directors and executive officers as a group (32 persons) | Common Stock | 9,555,261 | * | |||||||

| Depositary Shares | 25,000 | * | ||||||||

10  ï 2016 Proxy Statement

ï 2016 Proxy Statement

No change in control of Regions has occurred since January 1, 2012, meaning that no person or group has acquired the abilityHow to direct or cause the direction of management and policies of Regions through the ownership of voting securities, by contract, or otherwise, and no arrangements are known to Regions which may at a later date result in such a change in control of Regions.

In February 2013, the Board of Directors amended the Regions General Policy on Insider Trading to prohibit hedging transactions and future pledging of Company equity securities by our Directors and Executive Officers. Additionally, under amendments to the Director Stock Ownership Guidelines (the “Guidelines”) also approved by the Board in February 2013, Directors who currently have pledged Regions equity securities as collateral for a loan must reduce their pledged equity securities over time so as to eliminate all pledged Regions equity securities by the 2016 annual meeting of stockholders. Equity securities that are pledged will not be counted in determining stock ownership under the Guidelines.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires Regions’ executive officers, Directors and persons who own more than 10% of a registered class of Regions equity securities, if any, to file reports of ownership and changes in ownership of Regions stock with the SEC. Executive officers, Directors and greater than 10% stockholders are required by SEC regulations to furnish Regions with copies of all Section 16(a) forms they file.

Based solely on a review of the forms filed during or with respect to fiscal year 2012 and written representations from the reporting persons, Regions believes that its officers and Directors filed all required reports on a timely basis, except for one Form 4 filed five days late on behalf of George W. Bryan reporting the purchase of 895 shares in a managed brokerage account.

PROPOSAL 1—ELECTION OF DIRECTORS

All Directors are elected on an annual basis. The Board has determined that following the annual meeting of stockholders, the Board will consist of 14 members, to be elected for a term of one year expiring at the next annual meeting of stockholders.The Board unanimously recommends the election of George W. Bryan, Carolyn H. Byrd, David J. Cooper, Sr., Don DeFosset, Eric C. Fast, O. B. Grayson Hall, Jr., John D. Johns, Charles D. McCrary, James R. Malone, Ruth Ann Marshall, Susan W. Matlock, John E. Maupin, Jr., John R. Roberts and Lee J. Styslinger III as Directors, to hold office for a term of one year expiring with the annual meeting of stockholders to be held in 2014, or until their successors are duly elected and qualified.Proxies will be voted FOR the nominees, unless otherwise directed. If any nominee is not available for election, in its discretion the Board may designate a substitute nominee. In that event the proxies will be voted for such substitute nominee. All of the nominees have indicated to us that they will be available to serve as Directors and therefore we do not anticipate that any substitute nominee or nominees will be required. The proxies will not be voted for more than 14 nominees.

Samuel W. Bartholomew, Jr. and Earnest W. Deavenport, Jr. have indicated their desire to retire from the Board when their current terms expire. Therefore, this year’s meeting will mark the retirement of Mr. Bartholomew and Mr. Deavenport as Directors. Mr. Bartholomew has served Regions with distinction as a member of the Board of Directors since 2001 when he joined the board of Union Planters Corporation, which merged with Regions in 2004. Mr. Deavenport joined the board of directors of First American Corporation in 1990, which later merged with AmSouth Bancorporation. When AmSouth merged into Regions in 2006, Mr. Deavenport joined the Company’s Board and served as Chair of the Risk Committee for two years. He has been Chairman of the Nominating and Corporate Governance Committee since July 2008 and has served as Non-Executive Chairman since April 1, 2010, playing a critical role in successfully guiding Regions through a period of significant challenges and transformational events. Mr. Bartholomew and Mr. Deavenport have served with distinction and have earned the admiration and respect of the Company and their colleagues.

Important: Brokers holding shares beneficially owned by their clients will not have the ability to cast votes with respect to the election of Directors unless they have received instructions from the beneficial owner of the shares. Therefore, in order for your vote to be counted regarding the election of Directors if your shares are held by a broker, you must provide instructions to your broker. Please instruct your broker how you want to vote by following the instructions contained in the notice or voting instruction form provided by your broker.

Information about Regions Directors and Nominees

The following biographies show the age and principal occupations during at least the past five years of each of the Directors, the date the Director was first elected to the Board of Regions, or companies merged with Regions, and the directorships they now hold and have held within at least the last five years with corporations subject to the registration or reporting requirements of the Securities Exchange Act of 1934 or registered under the Investment Company Act of 1940. The Board believes that all the nominees named below are highly qualified and each Director’s specific experiences, qualifications, attributes or skills that led the Board to conclude that he or she should serve as a Director are also described. There are no family relationships among our Directors and executive officers.

DIRECTOR NOMINEEScontact us:

| Investor Relations | Regions Financial Corporation 1900 Fifth Avenue North, Birmingham, Alabama 35203 205-581-7890 investors@regions.com | |

| Board of Directors | Regions Financial Corporation c/o Office of the Corporate Secretary 1900 Fifth Avenue North, Birmingham, Alabama 35203 | |

| Audit Committee of the Board of Directors | Regions Financial Corporation Attention: Ms. Carolyn H. Byrd Chair, Audit Committee c/o Office of the Corporate Secretary 1900 Fifth Avenue North, Birmingham, Alabama 35203 |

Proposal 1 – Election of Directors (page 26)

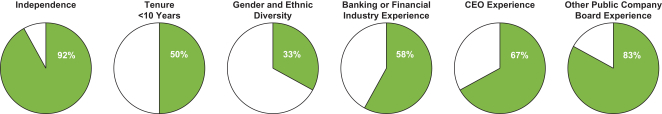

The following chart sets forth information with respect to our 11 nominees standing for election:

| Age | Independent | Principal Occupation | Other Boards (1) | Regions Board Committee(s) | ||||||||||

| 67 | Yes | Chairman and CEO, GlobalTech Financial, LLC |

• Federal Home Loan Mortgage Corporation | • Audit Committee (Chair)

| |||||||||

David J. Cooper, Sr. | 70 | Yes | Vice Chairman, Cooper/ T. Smith Corporation | • Alabama Power Company* | • Compensation Committee • Nominating and Corporate Governance (“NCG”) Committee | |||||||||

Don DeFosset | ||||||||||||||

| 67 | Yes | Retired Chairman,

Walter Industries, Inc. |

• National Retail Properties

| |||||||||||

|

• Risk Committee | |||||||||||||

Eric C. Fast (2) | 66 | Yes | Retired CEO, Crane Co. | • Automatic Data Processing, Inc.

| • Audit Committee • Risk Committee | |||||||||

O. B. Grayson Hall, Jr. | 58 | No | Chairman, President and CEO, Regions Financial Corporation and Regions Bank | • Vulcan Materials Company • Alabama Power Company* | ||||||||||

John D. Johns (4) | 64 | Yes | Chairman and | • Genuine Parts Company • The Southern Company | • NCG Committee • Risk Committee | |||||||||

Ruth Ann Marshall | 61 | Yes | Retired President, The Americas, MasterCard International, Inc. | • ConAgra Foods, Inc. • Global Payments, Inc. | • Compensation Committee • NCG Committee | |||||||||

Susan W. Matlock | 69 | Yes | Retired President and CEO, Innovation Depot, Inc. | • Compensation Committee • Risk Committee | ||||||||||

John E. Maupin, Jr. (2) | 69 | Yes | Retired President, Morehouse School of | • LifePoint Health, Inc. • VALIC Company I and II • HealthSouth Corporation | • Audit Committee • NCG Committee | |||||||||

Charles D. McCrary (3) | 64 | Yes | Retired President and | • NCG Committee (Chair) | ||||||||||

Lee J. Styslinger III (2) | 55 | Yes | Chairman and CEO, Altec, Inc. | • Vulcan Materials Company | • Audit Committee • Compensation Committee |

| (1) | Corporations subject to the registration or reporting requirements of |

| (2) | Audit Committee Financial Expert. |

| (3) | Lead Independent Director. |

| (4) | Risk Management Expert. |

| * | Alabama Power Company has no publicly traded common stock. |

ï 2016 Proxy Statement11

ï 2016 Proxy Statement11

| PROXY SUMMARY |

Corporate Governance (page 38)

Regions has a long-standing commitment to providing effective governance of the Company’s business and affairs for the benefit of stockholders. The Board’s NCG Committee periodically reviews our Corporate Governance Principles to maintain effective and appropriate standards of corporate governance. A commitment to strong governance practices is a hallmark of the Board’s stewardship on behalf of stockholders and stakeholders. As such, we regularly review our practices to ensure effective collaboration between management and our Board.

Below are some of the governance best practices that we follow.

What We Do

Mr. Cooper graduated from the University of Alabama School of Commerce and Business Administration and joined his family’s stevedoring company, Cooper/ T. Smith Corporation. Under the direction of Mr. Cooper and his brother, the company has grown and diversified and now operates in 37 ports on the East, West and Gulf Coasts of the United States, and has operations in South America. The company has also diversified its business interests, including warehousing, terminal operations, tugboats, push boats, barging and restaurants. Mr. Cooper served on the board of directors of SouthTrust Bank prior to joining the board of AmSouth Bancorporation, which merged with Regions in 2006. Mr. Cooper is active in civic and educational organizations. Mr. Cooper’s service on the board of Alabama Power Company provides him with insight in dealing with another regulated industry. He also brings to our Board extensive knowledge of how to effectively run a large business as evidenced by the diversification and growth of Cooper/T. Smith Corporation under Mr. Cooper’s direction. His experience makes him well qualified to be a member of Regions’ Board.

|

|

| Continuous Focus on Strategic Planning | The Board and management regularly focus on strategy and planning. | ||

| Maintain an Overwhelmingly Independent Board | Of the Board’s current 12 Directors, 11 are independent, including the Lead Independent Director. | ||

ü | Recruit the Best Directors | Our Board reflects a range of talents, ages, skills, diversity and expertise. | ||

| Strive for Board Diversity | Currently, 25 percent of our Directors are female and 17 percent are ethnically diverse. | ||

ü | Maintain a Declassified Board | Directors are elected annually by a majority of votes cast in an uncontested election. | ||

ü | Hold Frequent Board and Committee Meetings | The Board held 9 meetings in 2015, and the Board’s Committees held 28 meetings in 2015. The Board meets in executive session at each regular Board meeting and most conference call Board meetings. | ||

ü | Expect Director Attendance at Meetings | Our current Director attendance for Board and Committee meetings averaged over 96 percent in 2015, and each Director attended over 75 percent of Board and Committee meetings on which the Director served. | ||

ü | Maintain Independent Committees | The Board has | ||

ü | Maintain Corporate Governance Principles | The Board has adopted comprehensive Corporate Governance Principles to guide its oversight and independent governance leadership. | ||

ü | Conduct Board Self-Evaluations | The Board and Committees conduct annual self-evaluations. | ||

ü | Facilitate a Director | The Board has | ||

ü | Conduct CEO Evaluation | The Board conducts an annual evaluation of the Chief Executive Officer. | ||

ü | Administer Board Orientation | New Directors are provided with an orientation package and attend a Board orientation session, including Committee-specific orientation sessions, as appropriate. | ||

ü | Maintain Stock Ownership Requirements | Robust stock ownership guidelines for Directors and executive officers are in place. | ||

ü | Properly Align Executive Compensation | We have specific policies and practices to align executive compensation with long-term stockholder interests; these policies and practices are routinely reviewed by the | ||

ü | Provide for | We have adopted an enhanced clawback policy that applies to our executive officers, as | ||

ü | Review Management and Succession Planning | The Board reviews management talent and succession at least annually. | ||

ü | Promote Cross-Committee Membership | The Chairs of the | ||

ü | Administer a Code of | The Company adopted a comprehensive Code of

| ||

ü | Maintain an Ethics Council | Our internal Ethics Council ensures proper oversight and | ||